Navigating Tax Calculations in Quebec: Why a Comptable in Montreal is Essential

Tax season can be a daunting time for many individuals and businesses, particularly when navigating the complex tax regulations in Quebec. Whether you're a business owner or an individual taxpayer, understanding your tax obligations and ensuring compliance is crucial. This is where a Comptable Montreal can play a vital role. This blog will explore the importance of hiring a comptable in Montreal, how they can assist with calcul du taxe Québec (Quebec tax calculations), and why professional help can make a significant difference.

Understanding the Role of a Comptable in Montreal

A comptable—or accountant in English—is more than just a numbers person. They are financial experts who provide a range of services that can help you manage your finances efficiently and ensure compliance with tax regulations. In Montreal, comptables offer specialized knowledge of both federal and provincial tax laws, which is essential for navigating the complexities of Quebec’s tax system.

Key Responsibilities of a Comptable:

- Tax Planning and Preparation:

- Comptables are adept at preparing and filing tax returns for both individuals and businesses. They ensure that all income, deductions, and credits are accurately reported, helping to minimize tax liabilities and avoid penalties.

- Tax Calculations:

- Quebec has specific tax regulations that differ from other provinces, including unique tax credits and deductions. A comptable in Montreal is well-versed in these local tax rules and can perform precise calcul du taxe Québec, ensuring that you comply with all provincial requirements.

- Financial Advice:

- Beyond taxes, comptables offer valuable financial advice on budgeting, financial planning, and investment strategies. They can help you make informed decisions that align with your long-term financial goals.

- Business Services:

- For businesses, comptables handle bookkeeping, payroll, and financial reporting. They also assist with business tax filings, including corporate income tax returns and GST/QST reports.

- Audit Assistance:

- In the event of an audit by tax authorities, a comptable provides support and guidance. They ensure that all documentation is in order and represent your interests during the audit process.

The Importance of Accurate Calcul du Taxe Québec

Calcul du taxe Québec refers to the process of calculating taxes according to Quebec’s specific regulations. This includes both personal income tax and corporate tax. Understanding and applying these calculations correctly is critical to avoid issues with the tax authorities.

1. Quebec Income Tax:

- Quebec has its own income tax rates and brackets, which are distinct from federal rates. For 2024, Quebec’s provincial tax brackets include rates ranging from 15% to 25.75% on taxable income. A comptable ensures that your income is accurately reported and that you take advantage of applicable credits and deductions, such as the Quebec Solidarity Tax Credit or the Refundable Tax Credit for Experienced Workers.

2. Goods and Services Tax (GST) and Quebec Sales Tax (QST):

- Businesses operating in Quebec must account for both GST and QST on their sales. The GST rate is 5%, while the QST rate is 9.975%. Accurate calculation and remittance of these taxes are essential for compliance. A comptable helps businesses manage these taxes effectively, ensuring correct reporting and payment.

3. Tax Credits and Deductions:

- Quebec offers various tax credits and deductions, such as the Childcare Expenses Deduction and the Tuition Tax Credit. A comptable can identify and apply these credits appropriately, maximizing your tax benefits.

Why Choose a Comptable in Montreal?

1. Local Expertise:

- Montreal comptables have specialized knowledge of Quebec’s tax laws and regulations. They stay updated on changes in local tax policies, ensuring that your tax calculations and filings are current and accurate.

2. Personalized Service:

- A comptable in Montreal provides tailored services based on your specific financial situation. Whether you are an individual taxpayer or a business owner, they offer customized solutions that address your unique needs.

3. Peace of Mind:

- Handling taxes can be stressful and time-consuming. By hiring a comptable, you delegate these responsibilities to a professional, allowing you to focus on other important aspects of your life or business.

4. Compliance and Accuracy:

- Mistakes in tax calculations can lead to penalties and audits. A comptable ensures that your tax returns are accurately prepared and filed, reducing the risk of errors and ensuring compliance with tax regulations.

5. Strategic Planning:

- Beyond tax preparation, comptables offer strategic financial planning services. They help you plan for future tax liabilities, optimize your financial situation, and achieve your long-term financial goals.

Finding the Right Comptable in Montreal

When looking for a comptable in Montreal, consider the following tips:

- Check Qualifications and Experience:

- Ensure that the comptable is a licensed professional with relevant experience in tax preparation and financial planning. Look for certifications such as CPA (Chartered Professional Accountant).

- Read Reviews and Testimonials:

- Research reviews and testimonials from previous clients to gauge the comptable’s reputation and reliability. Positive feedback can provide confidence in their services.

- Assess Their Specializations:

- Choose a comptable with experience relevant to your specific needs, whether it’s personal tax returns, business accounting, or tax planning.

- Consider Communication and Accessibility:

- Effective communication is key to a successful working relationship. Choose a comptable who is responsive and accessible, making it easy to discuss your financial concerns.

- Compare Fees:

- While cost shouldn’t be the only factor, it’s important to understand the fees associated with the comptable’s services. Compare pricing and ensure that it aligns with your budget.

Conclusion

Navigating Calcule De Taxe Québec can be complex, especially for those with bad credit or complex financial situations. A comptable in Montreal plays a crucial role in ensuring accurate tax calculations, compliance with Quebec’s tax regulations, and effective financial management. By leveraging the expertise of a comptable, you can manage your tax obligations with confidence, optimize your financial situation, and achieve peace of mind. Whether you’re an individual taxpayer or a business owner, enlisting the help of a skilled comptable is an investment in your financial health and success.

TAGS :

RECOMMENDED FOR YOU

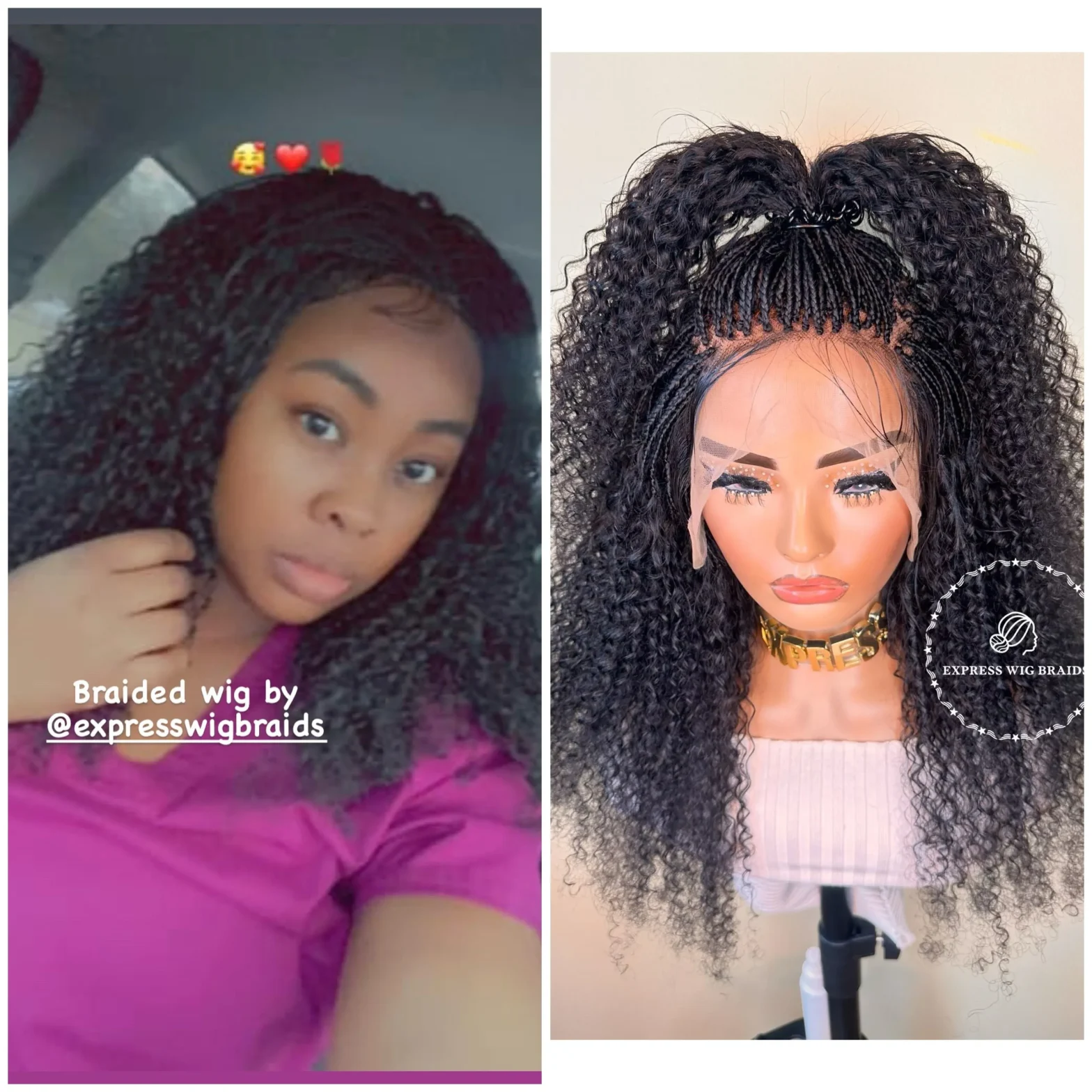

The Beauty and Benefits of Human Hair Braided Wigs

October 29, 2024

Discover the Most Fun Yacht Charters and Boat Rentals in Kelowna

August 30, 2024